In today’s world, our pets are more than just animals; they are family members. As such, ensuring their health and well-being is paramount. One effective way to achieve this is through cat insurance. This article will delve into the growing importance of cat insurance, the myriad benefits it offers, and how to choose the right plan for your beloved feline friend.

Mục lục

- 1. Overview of Cat Insurance

- 2. Key Benefits of Cat Insurance

- 3. Related articles 01:

- 4. Understanding Different Types of Cat Insurance Policies

- 5. How to Choose the Right Cat Insurance Plan

- 6. Top 5 Cat Insurance Providers in US 2024

- 7. Related articles 02:

- 8. Real-Life Examples of Cat Insurance in Action

- 9. Conclusion

Overview of Cat Insurance

Cat insurance is a type of pet insurance policy designed specifically to cover various health-related expenses for cats. This can range from accidents and illnesses to routine care and preventive measures. Policies can vary widely, but most include coverage for veterinary visits, diagnostic tests, surgeries, medications, and sometimes even alternative therapies like acupuncture or chiropractic care. By investing in cat insurance, pet owners can mitigate the financial burden of unexpected medical bills and ensure their cats receive prompt and appropriate care.

What is Cat Insurance?

Cat insurance is essentially a safety net, providing coverage for various health-related expenses that may arise during your cat’s life. It works similarly to human health insurance, requiring you to pay a monthly or annual premium in exchange for financial support when your cat needs veterinary care. Different policies offer varying levels of coverage, so it’s essential to choose one that aligns with your cat’s specific needs and your budget.

Types of Coverage

Cat insurance policies typically fall into a few broad categories: accident-only, illness-only, and comprehensive plans. Accident-only plans cover injuries resulting from unexpected incidents like car accidents or falls. Illness-only plans cater to health issues such as infections, cancer, or chronic conditions. Comprehensive plans offer the most extensive coverage, including both accidents and illnesses, as well as routine care like vaccinations, dental cleaning, and wellness exams. Some policies even provide coverage for hereditary and congenital conditions, which can be particularly beneficial for pedigree cats prone to genetic issues.

Why You Should Buy Cat Insurance

Investing in cat insurance is a proactive step in safeguarding your feline friend’s health and well-being. One of the primary reasons to purchase cat insurance is the peace of mind it offers. Knowing that you are financially prepared for any unforeseen medical expenses can alleviate the stress associated with sudden illnesses or injuries. Additionally, cat insurance can significantly reduce out-of-pocket veterinary costs, allowing you to make decisions based on the best interests of your cat without being hindered by financial constraints.

Another compelling reason to consider cat insurance is the increasing cost of veterinary care. Advances in veterinary medicine now offer a wide range of sophisticated treatments and diagnostic tools, but these often come with substantial price tags. With cat insurance, you can ensure your pet has access to the best possible care without compromising on quality due to cost concerns.

Furthermore, many cat insurance policies provide coverage for routine preventive care, such as vaccinations, flea and tick treatments, and annual check-ups. These preventative measures are crucial for maintaining your cat’s health and can help detect potential issues early, leading to more effective and less expensive treatments.

Key Benefits of Cat Insurance

Cat insurance offers numerous benefits to pet owners. Some of the most significant advantages include:

- Financial protection against unexpected medical costs

- Ability to provide your cat with prompt and appropriate care without worrying about costs

- Reduced out-of-pocket expenses for routine preventive care

- Coverage for hereditary and congenital conditions, which can be costly to treat without insurance

- Flexible plan options to cater to your cat’s specific needs and your budget

- Peace of mind knowing that you are prepared for any medical emergencies that may arise

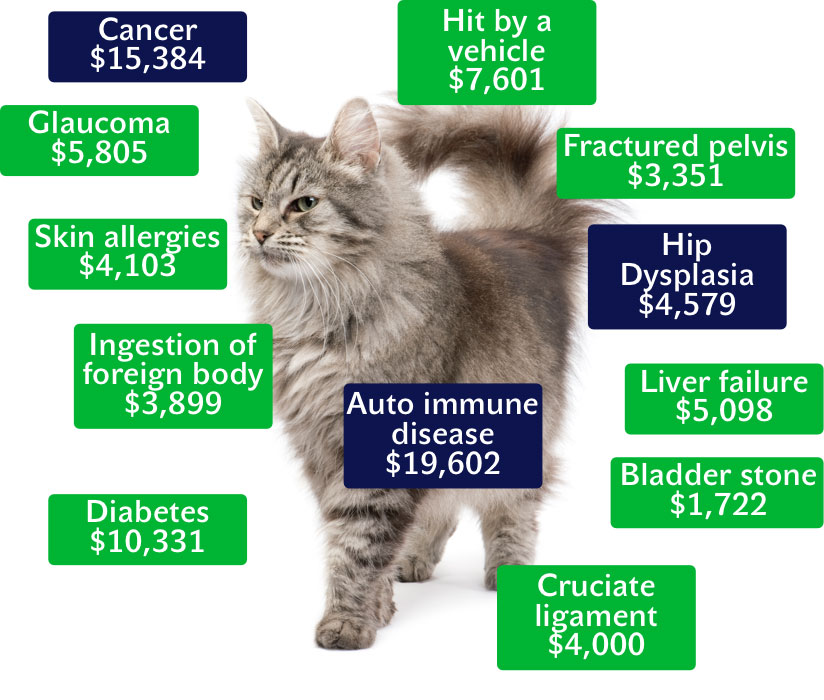

Financial Protection

One of the primary advantages of cat insurance is the financial protection it offers. Veterinary emergencies can be costly, and without insurance, pet owners might find themselves facing challenging decisions about their cat’s care due to financial constraints. With cat insurance, a significant portion of these expenses is covered, making it easier to afford the necessary treatments and procedures. This financial safety net means that cat owners don’t have to dip into savings or forgo other important expenses to cover unexpected vet bills.

Access to Qualified Veterinary Care

With cat insurance, pet owners have the freedom to choose the best possible care for their feline companions. High-quality veterinary care, including specialist consultations, advanced diagnostics, and cutting-edge treatments, is more accessible when the financial burden is shared with an insurance provider. This enables pet owners to pursue the best treatment options without being limited by cost, ensuring that their cats receive the highest standard of care available.

Flexibility and Customization

Cat insurance plans are highly customizable, allowing pet owners to select the coverage that best suits their cat’s needs and their budget. Whether you require a basic plan that covers only accidents or a comprehensive policy that includes preventive care, there are options available to meet your specific requirements. This flexibility ensures that you are not paying for coverage you don’t need while still providing adequate protection for your cat’s health.

Comprehensive Coverage

Comprehensive coverage plans are designed to offer the most extensive protection for your cat’s health. These policies typically include a wide range of services, such as accident and illness coverage, routine care, dental cleanings, and even alternative therapies like acupuncture. By opting for comprehensive coverage, you ensure that your cat is well-protected against virtually any health issue that may arise, reducing your out-of-pocket expenses and providing peace of mind. Some comprehensive plans also cover hereditary and congenital conditions, which can be critical for breeds that are prone to specific genetic disorders.

1. https://dodopet.info/the-ultimate-guide-to-dog-insurance-protecting-your-best-friend-2323/

2. https://dodopet.info/figo-pet-insurance-costco-a-comprehensive-guide-for-pet-owners-2222/

3. https://dodopet.info/the-essential-guide-to-buying-pet-insurance-for-responsible-pet-owners-2223/

4. https://dodopet.info/chubb-pet-insurance-comprehensive-protection-for-your-furry-friends-2220/

Savings on Routine and Preventive Care

Many cat insurance policies offer coverage for routine and preventive care, including vaccinations, flea and tick treatments, and annual check-ups. By having these services covered by insurance, pet owners can save a significant amount on their out-of-pocket expenses. Regular preventive care is essential for maintaining your cat’s health and detecting potential issues early on. With cat insurance covering these costs, you can ensure that your cat receives the necessary preventative measures without worrying about the financial burden.

Understanding Different Types of Cat Insurance Policies

When navigating the world of cat insurance, it’s important to understand the different types of policies available. Each type offers varying levels of coverage and benefits, catering to different needs and budgets.

Accident-Only Policies

Accident-only policies are designed to cover medical expenses resulting from unexpected accidents such as fractures, burns, or ingestion of toxic substances. These policies typically do not cover illnesses or preventive care but can be an affordable option for pet owners looking for basic financial protection against unforeseen accidents. Accident-only policies are ideal for younger, generally healthy cats who are less likely to require extensive medical treatment.

Time-Limited Policies

Time-limited policies provide coverage for both accidents and illnesses but with restrictions on the duration of coverage. Generally, these policies cover a specific condition for a set period, usually 12 months from the time of diagnosis or up to a specified financial limit. Once the time limit or financial cap is reached, the coverage for that particular condition ceases. Time-limited policies can be a cost-effective way to secure short-term coverage for your cat but may not be suitable for managing long-term or chronic conditions.

Maximum Benefit Policies

Maximum benefit policies offer a fixed financial limit per condition but do not impose a time constraint. This means that you can claim for a particular condition until the financial cap is reached. Once the limit is exhausted, no further claims for that condition can be made. These policies offer more extensive coverage than time-limited options and can be useful for managing ongoing medical issues without the pressure of a time limit.

Lifetime Policies

Lifetime policies are the most comprehensive and typically the most expensive type of cat insurance. These policies provide coverage for accidents and illnesses throughout your cat’s life, with annual limits that renew each policy year. As long as the policy is active, your cat will continue to receive coverage for ongoing and chronic conditions, subject to annual claim limits. Lifetime policies offer peace of mind for pet owners who want the most extensive and continuous coverage for their feline companions.

How to Choose the Right Cat Insurance Plan

Tips for Choosing the Right Cat Insurance Policy

Selecting the right cat insurance policy can be a complex process. Here are some tips to help you make an informed decision:

- Assess Your Cat’s Health Needs: Consider your cat’s age, breed, and any pre-existing health conditions when selecting a policy. Some breeds are prone to specific genetic illnesses that may require more comprehensive coverage.

- Compare Policies: Shop around and compare different insurance providers and policies. Look at the coverage details, exclusions, limits, and premiums to find the best value for your needs.

- Read the Fine Print: Ensure you understand the terms and conditions of any policy you are considering. Pay attention to exclusions, waiting periods, and any annual or per-condition limits.

- Consider Your Budget: Balance the level of coverage with what you can afford. While lifetime policies offer the most extensive protection, they also come with higher premiums.

- Check Reviews and Ratings: Look for reviews and ratings of insurance providers from other pet owners. This can give you insight into the company’s customer service, claims process, and overall reliability.

By taking the time to understand the various types of cat insurance policies and considering your cat’s unique health needs and your budget, you can choose a policy that offers the best protection and peace of mind for you and your feline friend.

Factors to Consider before Choosing Cat Insurance Plan

Choosing the right cat insurance plan involves considering several factors:

- Budget: Determine how much you’re willing to spend on premiums and potential out-of-pocket costs.

- Coverage Needs: Assess the specific health risks and needs of your cat. Older cats or those with pre-existing conditions may require more comprehensive coverage.

- Policy Terms: Read the fine print to understand what is covered, the limits of the coverage, and any exclusions.

- Reviews and Reputation: Research various insurance providers, looking for customer reviews and ratings to gauge reliability and customer satisfaction.

- Customer Service and Claims Process: Look into the insurance company’s customer service reputation, as well as their claims process. A quick and efficient claims process can make a significant difference in your overall experience with the policy.

Top 5 Cat Insurance Providers in US 2024

Here are the top 5 cat insurance providers in the US for 2024, based on coverage options, customer service, claims process, and overall value.

1. Healthy Paws

Healthy Paws is renowned for its comprehensive coverage and excellent customer service. The company offers unlimited lifetime coverage without caps on claims, which is ideal for cat owners seeking extensive protection for their pets. Policies cover accidents, illnesses, hereditary conditions, emergency care, and even alternative treatments like acupuncture and chiropractic care. Healthy Paws also boasts a straightforward claims process, often reimbursing claims within a few days.

2. Embrace Pet Insurance

Embrace Pet Insurance is a popular choice due to its customizable policies and focus on wellness rewards. In addition to covering accidents, illnesses, and genetic conditions, Embrace offers an optional Wellness Rewards program that helps cover routine care such as vaccinations, flea prevention, and annual check-ups. The company also provides diminishing deductibles, meaning your deductible decreases by $50 each year you don’t receive a claim reimbursement.

1. https://dodopet.info/figo-pet-insurance-costco-a-comprehensive-guide-for-pet-owners-2222/

2. https://dodopet.info/the-ultimate-guide-to-dog-insurance-protecting-your-best-friend-2323/

3. https://dodopet.info/chubb-pet-insurance-comprehensive-protection-for-your-furry-friends-2220/

4. https://dodopet.info/the-essential-guide-to-buying-pet-insurance-for-responsible-pet-owners-2223/

3. Petplan

Petplan is known for its extensive coverage that includes dental treatments, holistic care, and even behavioral therapies. With no upper age limits, Petplan is a fitting option for cats of all ages. The company provides flexible policy options allowing you to choose your deductible, reimbursement percentage, and annual limit. Petplan’s dedicated app streamlines the claims process and offers customers the convenience of easy policy management on the go.

4. Figo Pet Insurance

Figo Pet Insurance stands out with its tech-savvy approach to pet insurance, incorporating innovative features and a user-friendly app. Offering three levels of coverage, Figo provides reimbursement for accidents, illnesses, hereditary conditions, and exam fees. Its cloud-based Pet Cloud function allows pet owners to store medical records, schedule reminders, and easily file claims. Figo also offers exam fee coverage and a shorter waiting period for accident coverage compared to many competitors.

5. Nationwide Pet Insurance

As one of the largest and most established pet insurers, Nationwide offers a variety of plans, including Whole Pet with Wellness, Major Medical, and Pet Wellness. Their comprehensive Whole Pet with Wellness Plan provides extensive coverage including accidents, illnesses, hereditary conditions, wellness checks, and dental care. Nationwide is well-regarded for its wide coverage options and straightforward claims process, making it a solid choice for pet owners seeking reliable insurance for their cats.

By thoroughly researching and comparing these top providers, you can make an informed decision that best suits your cat’s health needs and your financial situation.

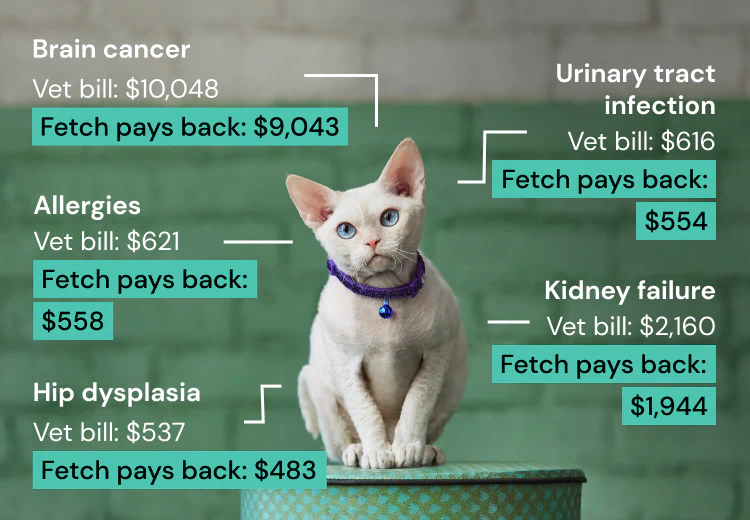

Real-Life Examples of Cat Insurance in Action

Cat insurance can be a lifesaver in unexpected and costly situations. Here are some real-life examples of how cat insurance has helped pet owners:

Case Study: Whiskers

“Whiskers,” a 5-year-old tabby cat, was diagnosed with a rare heart condition. Thanks to comprehensive cat insurance, Whiskers’ owner could afford the lifesaving surgery and post-operative care, ensuring Whiskers made a full recovery.

Testimonial: Felix’s Emergency Care

A user of “Pawsome Pet Insurance” shared their experience when their cat, “Felix,” required emergency care after an accident. The insurance coverage not only paid for most of the treatment costs but also supported additional expenses like follow-up appointments and medication.

Case Study: Smokey’s Preventive Care

With a “Meow & Forever” insurance policy, a cat owner shared how they could afford regular check-ups, vaccinations, and dental care for their cat, “Smokey,” without financial strain, ensuring Smokey’s long-term health.

Conclusion

As veterinary care continues to advance, the role of cat insurance becomes increasingly crucial. By providing financial protection, peace of mind, and comprehensive coverage, cat insurance ensures that your feline friend receives the best possible care. Investing in cat insurance is not just a financial decision; it’s a commitment to your cat’s health and well-being.

If you haven’t already, consider exploring the various cat insurance options available to find a plan that suits your needs and ensures your cat’s health is always a priority. With the right insurance, you can focus on creating lasting memories with your beloved pet, knowing they are protected every step of the way.